Namu Organizes Your Hustle

If you're self-employed, we know it takes guts to do what you do.

At Namu, our mission is to help you leverage that hustle and give you the tools you need to be successful.

Who is Namu?

We are freelancers like you, and we have run companies, prepared taxes, provided financial advice, managed investments, and built amazing financial systems running billions of dollars of assets.

We wanted to bring our decades of knowledge and experience together to help you be successful, and so Namu was born in 2018.

Our founding team are a couple of born and raised NYC natives, who want to make freelancing easier for you.

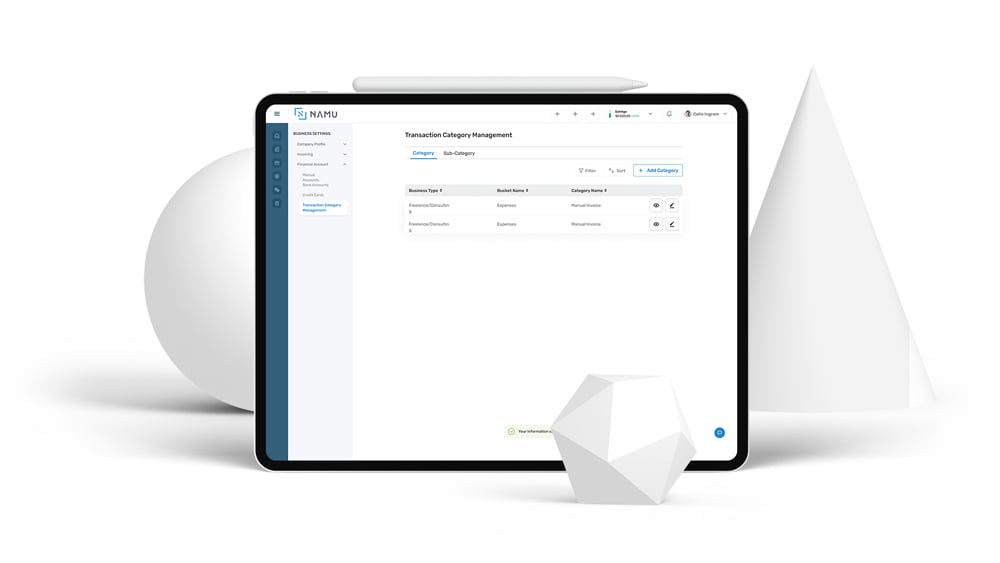

The Namu Platform

A platform that works for you, giving you what you need, when you want it.

INVOICING

How many invoices do you send?

Our robust invoicing module is built to make your life easier. The data from your invoices seamlessly connects to your bank and credit card transactions and ultimately flow into your tax planner so you always know where you stand when it comes to taxes. We also calculate sales tax for you natively in the system so if you’re selling products or merchandise and need to be sales tax compliant, we have you covered there too.

ACCOUNTING

Where do you start?

We have made accounting much simpler for you. No more Accounts Payable or Receivable, no journal entries, and no accruing income or expenses. We have built a custom accounting system specifically for the self-employed. The difference? Unlike other products that market to self-employed workers, our solution does not work for small to medium sized businesses – it’s built for the solopreneur.

TAX PLANNING

What’s this about estimated taxes?

Because of our custom, built-in automation, you can now look at your income and self-employed tax obligations at any time. Our tax planning module uses the data from various sources, including your invoices, bank and credit card transactions, and any manual data you enter, to calculate your quarterly tax estimates so you’re never behind. We also calculate your state and local income taxes, so you have an accurate view of your liabilities, avoiding interest and penalties.

RETIREMENT PLANNING

Are you saving enough?

Saving for retirement is a must. Our retirement planner will help you calculate how much you should set aside each month and tell you what you’ve saved on taxes. This is where the power of compounding shows its’ value as these savings are tax free! Namu can also help you open a retirement account and through our concierge plans, we can guide your retirement planning based on income and expense levels

REPORTING

Reporting!

Don’t forget about the value of running reports. When you’re ready to share your financials with others, we have a reporting module that provides you with the reports you need to run your business efficiently and smartly as someone who is self-employed. From income & expense (P&L) reports to Schedule C tax reports, all you’ll have to do is click a button!

What Namu Users Say

“As a first-time business owner, setting up accounts and figuring out what documentation I needed was very stressful. Not only did Namu set everything up for me, but they were also there to answer any questions I had no matter what time it was. Thank you, Namu!"

ChrisMassage Therapist

"Tons of other things that were problems in other software, are already solved in Namu. I liked how easy it was to start adding clients, creating invoices, templates, etc."

ChantelleFreelancer

"Taxes are intimidating, but Namu does makes it easier. I liked that the platform provides a variety of useful tools for freelancers in one place, and how it uses your data to make automatic calculations and break things down for the user in a detailed but easy to understand way."

FelixConsultant

Previous

Next

Sign up for our newsletter

Our monthly newsletter provides curated financial news, tips and tricks, and highlights of new Namu functionality for better managing your self-employed business.

What You Need to Know

A 1099 worker is also considered self-employed worker. You are your own 1-person business in the eyes of the IRS. Being a business, you are allowed to deduct business expenses, contribute to retirement at a higher rate, and have some other flexibilities. But with those benefits comes the need for accurate accounting, quarterly tax payments, and accurate expense tracking for deductions. A self-employed worker may receive 1099 form(s) from your clients at the beginning of the following calendar year. They are used to cross-check your earnings and to notify the IRS of these payments you received. Only a person who is self-employed receives these forms, either full-time or as a side-hustler.

However, in recent years with the increasing use of electronic payments, you may receive fewer 1099’s even though you had self-employed income. Therefore, do not think that you only need to report the income you received a 1099 form for, all income received throughout the year that was not part of your wages or investments needs to be accounted for on your taxes.

A W-2 employee is also called a wage earner. There are many differences between being a wage earner and being self-employed, but a few of the relevant ones are that your employer pays half of your FICA taxes on your behalf, and you receive a W-2 form at the beginning of the following calendar year that explain all your wages, withheld taxes, and other items.

As a wage earner, you can be either a part-time or full-time employee – hours worked does not distinguish between a W-2 employee and a self-employed worker.

If you’re just starting out (bravo!), and want to know if you are a match for Namu, here are some helpful filters:

• You send your client a completed W-9 form before you start work

• Your clients issue a 1099-MISC the following January or February (this may not happen if you are paid electronically)

• You have no employees or only employ other solopreneurs (meaning, no W2 employees)

If your answer is yes to any of the above, then you are a perfect match for Namu!

Our financial technology is detailed and sophisticated, it solves for the actual nuances that many self-employees face. For example, many software packages will calculate federal estimated taxes, but not State and Local. Also, Namu is fully integrated between your invoicing workflows, accounting, taxes and retirement, so you never need to enter your financial information twice, reducing errors, increasing accuracy, and saving you time. Finally, Namu provides a financial coach/mentor/guide to provide you with consultative sessions where we can learn about you and give you the best advice. Sometimes, you don’t know what questions to ask, so we take an open-ended consultative approach to learn about you, your business, your goals, so you can help us help you.